We follow ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Much of our research comes from leading organizations in the climate space, such as Project Drawdown and the International Energy Agency (IEA). Have you ever wondered how different it is to borrow money from your friends or family as against a bank? Before a bank credits your money, they need to know what is your company’s worth, what you own, and what you owe. Get a complete picture of your business finances, and in real-time, with QuickBooks financial reports. However, if a balance sheet is scattered information, you cannot extract the required information.

- Non-current assets, including property, plant, and equipment (PP&E), and long-term investments, are anticipated to provide economic benefit beyond a single operating cycle or one year.

- Current liabilities like current assets have an existence of the current financial year or the current operating cycle.

- Oftentimes, the notes will be more voluminous than the financial statements themselves.

- With a classified balance sheet, investors, creditors, and other stakeholders can easily assess a company’s liquidity by looking at the current assets and liabilities.

- Additionally, all classifications can contain individualized assets or liabilities based on industry norms and unique operating factors.

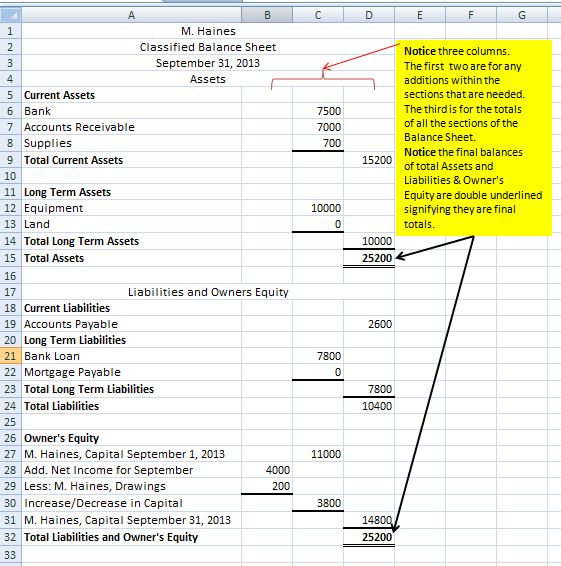

Understanding the Classified Balance Sheet

These are further categorized into current and non-current liabilities. Tickmark, Inc. and its affiliates do not provide legal, tax or accounting advice. The information provided on this website does not, and is not intended to, constitute legal, tax or accounting advice or recommendations. All information prepared on classified balance sheet template this site is for informational purposes only, and should not be relied on for legal, tax or accounting advice. You should consult your own legal, tax or accounting advisors before engaging in any transaction. The content on this website is provided “as is;” no representations are made that the content is error-free.

Prepaid Rent: Asset or Liability?

An important characteristic is that they can be easily liquidated to generate cash, which helps a business meet any short-term liquidity crunches. Although they vary from industry to industry, some common examples can be cash, cash equivalents, Inventory, accounts receivable, etc. A classified balance sheet is like a big box that holds information about what a company owns and owes, all sorted into neat groups. It’s a special kind of balance sheet that helps everyone understand the company’s financial health better. This type of balance sheet segregates the assets, liabilities, and equity into classifications or categories, thus presenting a more detailed and clear picture of a company’s financial condition.

What is the Primary Difference Between Classified and Standard Balance Sheets? – FAQs

Subtracting the liabilities from the assets gives you the value of your equity. Having an accurate balance sheet can help you and your managers assess the company’s strengths and weaknesses and develop appropriate strategies moving forward. Balance sheets can help you identify trends and are commonly used when dealing with potential lenders, such as banks, investors, and suppliers.

The first group is called "current assets," which are things the business plans to use or turn into cash within one year, like the money in the cash register or the supplies in the store. The second group is "long-term assets," which are things the business will keep for more than one year, like a big machine or a patent for a new invention. When we talk about assets on a balance sheet, we're talking about all the things a business owns that have value.

They are one-time strategic investments that are required for the long-term survival of the business. For an IT industry, assets will be laptops, desktops, land, and so forth yet for a manufacturing firm, it tends to be equipment, hardware, and Machinery. A fundamental attribute of fixed assets is that they are accounted for at their book value and regularly get depreciated with time. This is your opportunity to group and analyze sections of financial data that are most relevant to your success. Within these classifications, you then assign particular accounts that correlate with the type of asset, liability, equity, or investment.

By understanding the detailed breakdown of assets and liabilities, businesses can maintain transparency and foster long-term financial stability. Traditional balance sheets don't make particular categorization between various sections, it only has sections for a company’s assets and liabilities. A classified balance sheet splits assets into various classes of assets, like fixed assets, current assets, properties, investments, long-term assets, and intangible assets. Likewise, a classified balance sheet segregates an organization's liabilities into classes like long-term liabilities, short-term liabilities, and equity. The shareholder equity is categorized into preferred stock, common stock, capital in excess of par and retained earnings. Financial management and reporting form the backbone of any successful business, providing insights into the financial health and stability of the organization.

Balance Sheet is a principal financial statement which shows the financial standing of the company at a particular time. It presents the snapshot of the company’s position at the date it is prepared. Other titles of balance sheet include statement of financial position and statement of financial condition.